LATEST: What is the job market in Austria like right now?

Austria has seen unemployment fall as job vacancies reach an all-time high record. So, what is the job market looking like right now in the country?

In the second quarter of 2022, according to Statistics Austria, a total of 4,438,900 persons aged 15 and over were employed, while 197,900 were unemployed. There were 206,300 job vacancies, another all-time high record in the country.

“The upswing in the domestic labour market continues and is not yet affected by the Ukraine war and its consequences for the global economy. Nevertheless, the labour market is facing great challenges: At 206,300, the number of job vacancies in the second quarter once again reached a record level, exceeding the number of job seekers for the first time”, said Statistics Austria Director General Tobias Thomas.

“This is a clear signal of the increasing shortage of skilled workers and labour”, he added.

READ ALSO: ‘We need immigration’: Austrian minister insists foreign workers are the only solution

Currently, the Alpine country has an employment rate of 74.1 percent among people between the ages of 15 to 64. The employment rate is higher for men (78.2 percent) than women (69.9 percent).

Job vacancies at new high

Since the second quarter of 2021, when unemployment was still high due to the Covid-19 pandemic, the labour market has recovered steadily, Statistics Austria said. In the first three months of 2022, there were 33 percent fewer unemployed than in the same period the year before.

At the same time, the number of job vacancies in Austria reached its highest level since the beginning of the time series in 2009, with a total of 206,300 vacancies.

READ ALSO: Six official websites to know if you’re planning to work in Austria

Compared to the previous year's quarter, an increase of 48.9 percent was recorded and even compared to the pre-crisis level (the first three months of 2019), there were 59.8 percent more vacancies advertised.

Where are these jobs?

All economic sectors covered by the job vacancy survey (manufacturing, services and public sector) recorded significantly more job vacancies in the second quarter of 2022, both compared to the same quarter of the previous year and compared to the pre-crisis level.

In the manufacturing sector, there were 52,400 vacancies, in the services sector, 124,800 and in the public sector, 29,100.

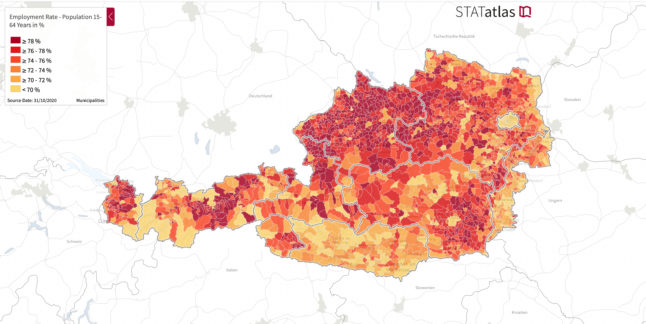

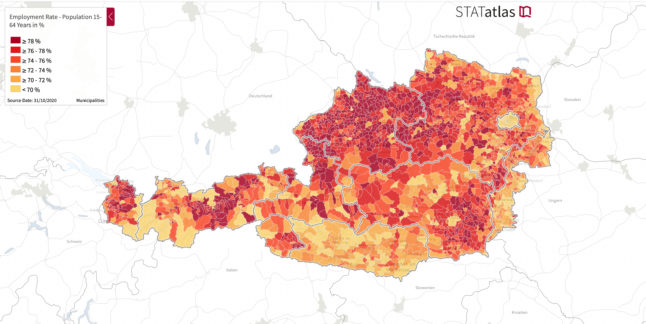

Screenshot from STATatlas

There is a stark difference in employment rates between the different states in Austria, as well. For example, the lowest rate is by far in Vienna, with 66.2 percent. The average in the country, in comparison, is 72.4 percent.

The highest employment rates are in Upper Austria (73.3 percent), Vorarlberg (76.2 percent), and Salzburg (75.5 percent). The lowest are Vienna (66.2 percent), Carinthia (70.7 percent) and Burgenland (71.8 percent).

Lower Austria's employment rate is 73.9 percent, Styria's is 72.9 percent, and Tyrol's is 74.1 percent.

READ ALSO: How Austria is making it easier for non-EU workers to get residence permits

Work from home schemes still in decline

In the second quarter of 2022, only 15.5 percent of those in employment still worked from home at the time of the survey. This corresponds to a decline of 4.4 percentage points compared to the same quarter of the previous year.

Additionally, only 4.5 percent stated that they were working from home because of the pandemic.

Comments

See Also

In the second quarter of 2022, according to Statistics Austria, a total of 4,438,900 persons aged 15 and over were employed, while 197,900 were unemployed. There were 206,300 job vacancies, another all-time high record in the country.

“The upswing in the domestic labour market continues and is not yet affected by the Ukraine war and its consequences for the global economy. Nevertheless, the labour market is facing great challenges: At 206,300, the number of job vacancies in the second quarter once again reached a record level, exceeding the number of job seekers for the first time”, said Statistics Austria Director General Tobias Thomas.

“This is a clear signal of the increasing shortage of skilled workers and labour”, he added.

READ ALSO: ‘We need immigration’: Austrian minister insists foreign workers are the only solution

Currently, the Alpine country has an employment rate of 74.1 percent among people between the ages of 15 to 64. The employment rate is higher for men (78.2 percent) than women (69.9 percent).

Job vacancies at new high

Since the second quarter of 2021, when unemployment was still high due to the Covid-19 pandemic, the labour market has recovered steadily, Statistics Austria said. In the first three months of 2022, there were 33 percent fewer unemployed than in the same period the year before.

At the same time, the number of job vacancies in Austria reached its highest level since the beginning of the time series in 2009, with a total of 206,300 vacancies.

READ ALSO: Six official websites to know if you’re planning to work in Austria

Compared to the previous year's quarter, an increase of 48.9 percent was recorded and even compared to the pre-crisis level (the first three months of 2019), there were 59.8 percent more vacancies advertised.

Where are these jobs?

All economic sectors covered by the job vacancy survey (manufacturing, services and public sector) recorded significantly more job vacancies in the second quarter of 2022, both compared to the same quarter of the previous year and compared to the pre-crisis level.

In the manufacturing sector, there were 52,400 vacancies, in the services sector, 124,800 and in the public sector, 29,100.

There is a stark difference in employment rates between the different states in Austria, as well. For example, the lowest rate is by far in Vienna, with 66.2 percent. The average in the country, in comparison, is 72.4 percent.

The highest employment rates are in Upper Austria (73.3 percent), Vorarlberg (76.2 percent), and Salzburg (75.5 percent). The lowest are Vienna (66.2 percent), Carinthia (70.7 percent) and Burgenland (71.8 percent).

Lower Austria's employment rate is 73.9 percent, Styria's is 72.9 percent, and Tyrol's is 74.1 percent.

READ ALSO: How Austria is making it easier for non-EU workers to get residence permits

Work from home schemes still in decline

In the second quarter of 2022, only 15.5 percent of those in employment still worked from home at the time of the survey. This corresponds to a decline of 4.4 percentage points compared to the same quarter of the previous year.

Additionally, only 4.5 percent stated that they were working from home because of the pandemic.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.