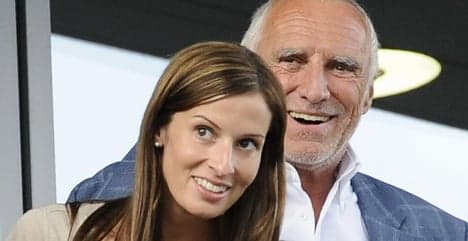

Mr Red Bull: Dietrich Mateschitz

One of the founders of the popular energy drinks brand, Red Bull, Dietrich Mateschitz is an Austrian entrepreneur and businessman with an estimated net worth of €5.2 billion.

Austria will host a Grand Prix for the first time in more than a decade when Formula 1 travels to Spielberg, in Styria, for round eight of the 2014 championship on June 20-22.

The Red Bull Racing team will be performing in front of what is effectively a home crowd, on the Red Bull Ring. Owner Mateschitz, who has just turned 70, is credited with having revived the region, never mind being one of the richest people in Austria.

Of Croatian ancestry, Mateschitz (known as Didi), was born in Sankt Marein im Mürztal, Styria.

After completing his marketing degree at the Vienna University of Economics and Business Administration, he was hired by Unilever for marketing detergents.

Subsequently, he started working for Blendax, a Germany-based cosmetic company. While working for Blendax, he discovered the drink Krating Daeng, which is now known as Red Bull.

Forty-nine percent of the company belongs to him, and 51 percent to the Thai family who introduced him to the drink when he was travelling in Asia. He was 43 when he started marketing the drink.

In November 2004 Mateschitz bought Jaguar Formula One, and later renamed it as Red Bull Racing.

Mateschitz also owns the NASCAR Team Red Bull. In 2004, he acquired the A1-Ring circuit of Formula One and renamed it to Red Bull Ring. A year later, he purchased SV Austria Salzburg, an Austrian football club which he later renamed to Red Bull Salzburg.

Mateschitz is considered a marketing genius, but his private world remains mysterious. He rarely does interviews and never answers questions about his private life.

His lifestyle is full of contradictions. Despite his wealth he appears down to earth - stubble, jeans, and an unbuttoned shirt is his usual look. But his hobbies are more exclusive. He owns the beautiful South Pacific Laucala Island. Renting a villa here will set you back €15,000 a day. Mateschitz lives in a 900-square-meter villa in Nonntal and owns an estate in Maria Alm. But his greatest passion is planes, and part of his collection is exhibited in Salzburg.

He’s rarely seen on the Red Carpet. "Whenever I go out, it just convinces me that actually I’m missing nothing," he told Bloomberg Businessweek. His long-term girlfriend Marion Feichtner is always at his side on the rare occasion that he does make a public appearance.

The heir to his empire is his only child Mark Gerhardter (21), the result of a two-year relationship between Mateschitz and former ski instructor, Anita. She is now head of the Mateschitz Foundation Wings for Life, a not-for-profit spinal cord research foundation. The two were never married. "I was too immature to get married," Mateschitz has said.

Mark wasn’t sent to an elite school but did his Matura at the vocational Werkschulheim Felbertal. Classmates describe him as bright, interested, and sporty. His father is now teaching him how to manage a billion euro business. In addition to studying business administration, Mark has also been touring the globe to learn about all the various branches of the Red Bull empire.

Mateschitz has also acquired some real estate around Spielberg. He owns the Renaissance castle Admontbichl in Obdach, and has made the Steirerschlössl castle in Zeltweg into a luxury hotel. He has also converted a former farmhouse in Großlobming into an exclusive country club, and snapped up Castle Thalheim in Pöls.

The Kurier paper writes that if his shopping spree continues, the Mur valley could soon be renamed the Red Bull Valley.

Comments

See Also

Austria will host a Grand Prix for the first time in more than a decade when Formula 1 travels to Spielberg, in Styria, for round eight of the 2014 championship on June 20-22.

The Red Bull Racing team will be performing in front of what is effectively a home crowd, on the Red Bull Ring. Owner Mateschitz, who has just turned 70, is credited with having revived the region, never mind being one of the richest people in Austria.

Of Croatian ancestry, Mateschitz (known as Didi), was born in Sankt Marein im Mürztal, Styria.

After completing his marketing degree at the Vienna University of Economics and Business Administration, he was hired by Unilever for marketing detergents.

Subsequently, he started working for Blendax, a Germany-based cosmetic company. While working for Blendax, he discovered the drink Krating Daeng, which is now known as Red Bull.

Forty-nine percent of the company belongs to him, and 51 percent to the Thai family who introduced him to the drink when he was travelling in Asia. He was 43 when he started marketing the drink.

In November 2004 Mateschitz bought Jaguar Formula One, and later renamed it as Red Bull Racing.

Mateschitz also owns the NASCAR Team Red Bull. In 2004, he acquired the A1-Ring circuit of Formula One and renamed it to Red Bull Ring. A year later, he purchased SV Austria Salzburg, an Austrian football club which he later renamed to Red Bull Salzburg.

Mateschitz is considered a marketing genius, but his private world remains mysterious. He rarely does interviews and never answers questions about his private life.

His lifestyle is full of contradictions. Despite his wealth he appears down to earth - stubble, jeans, and an unbuttoned shirt is his usual look. But his hobbies are more exclusive. He owns the beautiful South Pacific Laucala Island. Renting a villa here will set you back €15,000 a day. Mateschitz lives in a 900-square-meter villa in Nonntal and owns an estate in Maria Alm. But his greatest passion is planes, and part of his collection is exhibited in Salzburg.

He’s rarely seen on the Red Carpet. "Whenever I go out, it just convinces me that actually I’m missing nothing," he told Bloomberg Businessweek. His long-term girlfriend Marion Feichtner is always at his side on the rare occasion that he does make a public appearance.

The heir to his empire is his only child Mark Gerhardter (21), the result of a two-year relationship between Mateschitz and former ski instructor, Anita. She is now head of the Mateschitz Foundation Wings for Life, a not-for-profit spinal cord research foundation. The two were never married. "I was too immature to get married," Mateschitz has said.

Mark wasn’t sent to an elite school but did his Matura at the vocational Werkschulheim Felbertal. Classmates describe him as bright, interested, and sporty. His father is now teaching him how to manage a billion euro business. In addition to studying business administration, Mark has also been touring the globe to learn about all the various branches of the Red Bull empire.

Mateschitz has also acquired some real estate around Spielberg. He owns the Renaissance castle Admontbichl in Obdach, and has made the Steirerschlössl castle in Zeltweg into a luxury hotel. He has also converted a former farmhouse in Großlobming into an exclusive country club, and snapped up Castle Thalheim in Pöls.

The Kurier paper writes that if his shopping spree continues, the Mur valley could soon be renamed the Red Bull Valley.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.